March 14, 2024 (MLN): Global oil price continued its upward march on Thursday driven by a surprise withdrawal in U.S. crude inventories, a bigger-than-expected drop in gasoline stocks and potential supply concerns after Ukrainian attacks on Russian refineries.

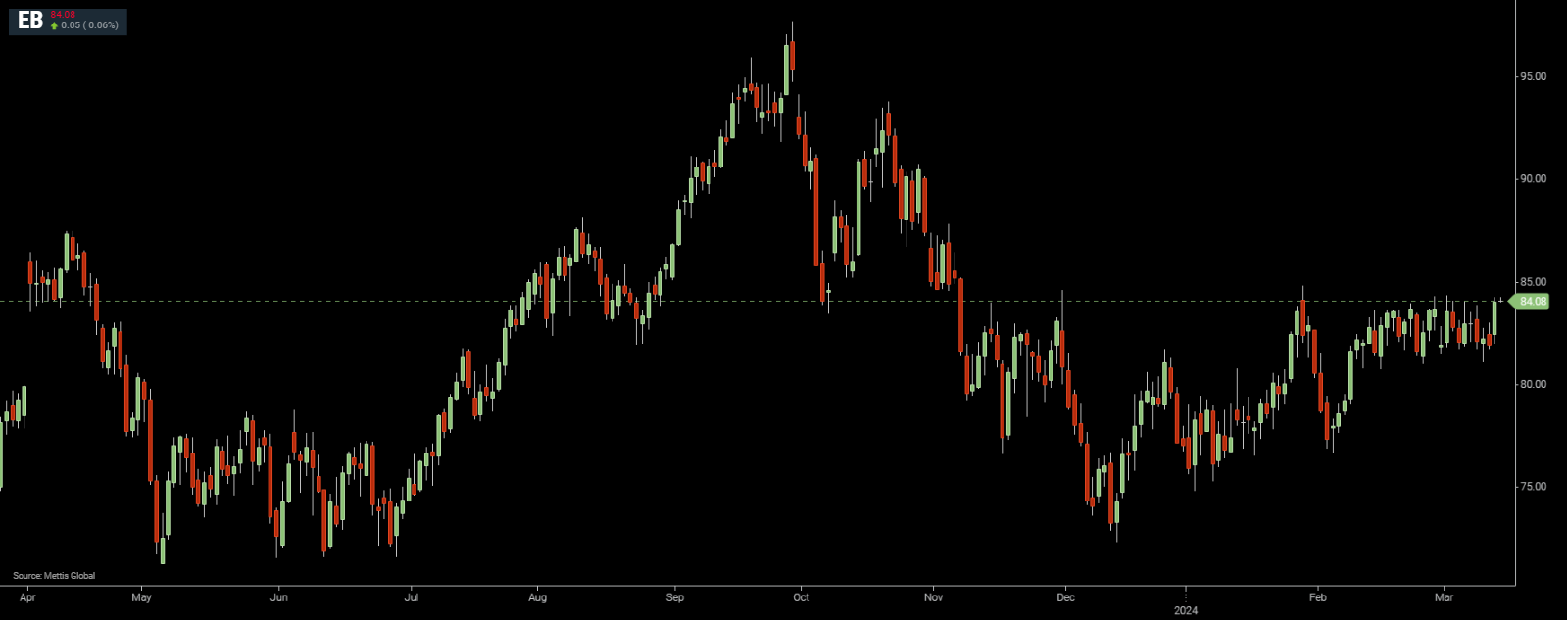

Brent crude traded near $83.63 per barrel, up by 0.19% on the day.

While West Texas Intermediate crude (WTI) was at $79.27 per barrel, up by 0.15% on the day.

Both benchmarks gained 1.46% and 1.89%, respectively yesterday on stronger demand and disruptive supply signals.

The U.S. Energy Information Administration (EIA) said energy firms pulled a surprise 1.5 million barrels of crude from stockpiles during the week ended March 08, as Reuters reported.

U.S. gasoline futures, meanwhile, showed the biggest price increase across the energy complex, rising about 2.9% to their highest since September 2023 after EIA said energy firms pulled a much larger-than-expected 5.7m barrels of gasoline from stockpiles last week.

That compares with the 1.9m-barrel withdrawal from gasoline stocks that analysts forecast in a Reuters poll.

"Gasoline is driving us today. There are growing concerns about growing tightness with a combination of seasonal maintenance and other outages," said Phil Flynn, an analyst at Price Futures Group.

That increase in gasoline prices boosted the gasoline- and 321-crack spreads, which measure refining profit margins, to their highest since August and September 2023, respectively.

In Russia, Ukraine struck oil refineries in a second day of heavy drone attacks, causing a fire at Rosneft's biggest refinery in what Russian President Vladimir Putin said was an attempt to disrupt his country's presidential election this week.

“As Russian refining capacity is damaged by Ukrainian drone strikes, this can result in Russia exporting less diesel fuel with a potential for Russia to start importing gasoline and that of course will affect prices around the world," said Andrew Lipow, president of Lipow Oil Associates in Houston.

Putin told the West that Russia was technically ready for nuclear war and that if the U.S. sent troops to Ukraine, it would be considered a significant escalation of the conflict. Putin, however, also said he saw no need for the use of nuclear weapons in Ukraine.

Oil and the wider financial markets also found support from sentiment that the latest data on U.S. inflation will not derail interest rate cuts by midyear.

Lower rates can boost economic growth and support oil demand.

The Organization of the Petroleum Exporting Countries (OPEC), meanwhile, stuck to its forecast for oil demand growth of 2.25m barrels per day (bpd) in 2024, higher than many other forecasts.

The International Energy Agency (IEA), which expects demand growth to be much lower, updated its forecasts on Thursday.

Copyright Mettis Link News

Posted on:2024-03-14T10:47:34+05:00

43945