March 08, 2024 (MLN): The cement sector showed modest performance in the second quarter of fiscal year 2024, as it mostly absorbed the impact of last year’s economic decisions.

The sector recorded a 9.6% QoQ growth in net profits, which clocked in at Rs21.2 billion as against Rs19.3bn in the previous quarter.

Despite stagnant dispatches in 2QFY24 amid economic slowdown, unprecedented inflation and high interest rates, profitability rose amid better cement prices and operational efficiencies.

The gross margins improved to 34.55% as against 29.92% in the previous quarter.

The overall cement industry’s total dispatches were recorded at 12 million tonnes, up 1% QoQ, according to All Pakistan Cement Manufacturers Association (APCMA) data.

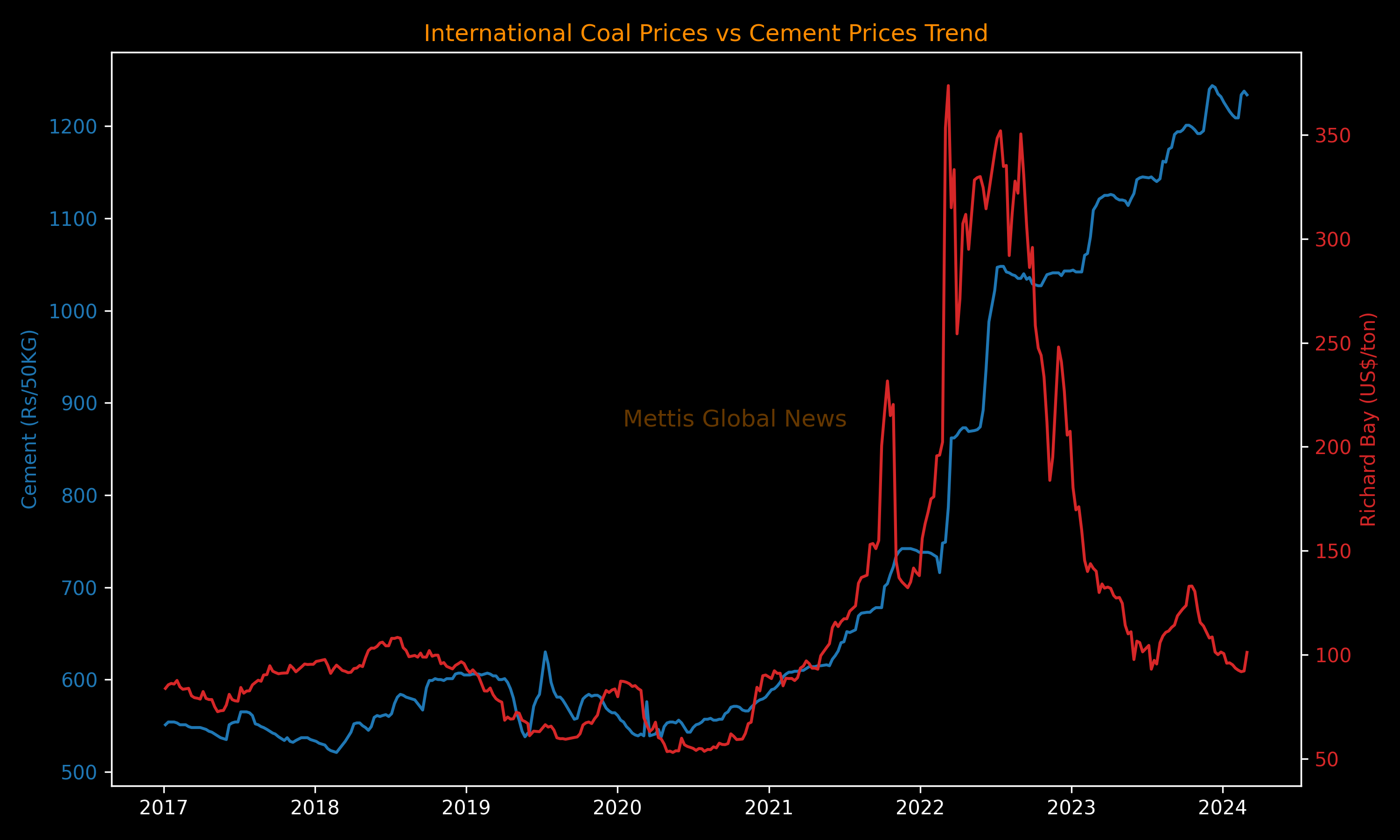

Coal trended downward during the review quarter providing much-needed relief in cost for the cement industry.

However, prices have started to pick up since February 2024 due to disruption in the Red Sea and landed cost have increased mainly due to an increase in sea freight.

Richard Bay Coal has increased more than 10% in the last month to about $100.

This has also resulted in a hike in locally available coal of Afghan origin.

As per the results compiled by Mettis Global of the income statements of these eight cement companies, the sector saw a fall of 19.3% QoQ in its sale revenue, worth Rs111.9bn as compared to Rs138.6bn in the previous quarter.

To note, the compiled sector result includes KSE-100 index companies, which are: BWCL, CHCC, DGKC, FCCL, KOHC, LUCK, MLCF, and PIOC.

The cost of sales fell 24.6% QoQ but was lesser than proportionate to the sales decline, reducing the gross profit by 6.8% QoQ to Rs38.6bn against a gross profit of Rs41.5bn in 1QFY24.

On the expense side, the sectors’ selling and distribution expenses inched up 0.7% QoQ, other operating expenses rose 1.4% QoQ, while administrative expenses fell 11.6% QoQ, amounting to Rs4.7bn, Rs2.3bn, and Rs1.9bn respectively.

During the review quarter, other income of the sector decreased by 22.3% QoQ to stand at Rs4.2bn in 2QFY24 as compared to Rs5.4bn in 1QFY24.

The sector's finance costs fell 9.6% QoQ and stood at Rs8.4bn as compared to Rs9.3bn in 1QFY24.

On the tax front, the sector paid a higher tax worth Rs11.3bn against the Rs10.3bn paid a quarter earlier, depicting a rise of 9.4% QoQ.

Pakistan is facing multiple challenges on all fronts and political and governance chaos will do no good, said D.G. Khan Cement Company Limited.

Massive debt repayments are ahead that may put further pressure on PKR/USD parity. This may create concern on cost side.

Keeping inflation projected numbers in view, discount rates will remain high throughout FY24.

| Unconsolidated (un-audited) Financial Results for quarter ended 31 December 2023 (Rupees in '000) | |||

|---|---|---|---|

| Dec-23 | Sep-23 | QoQ % Change | |

| Net Sales / Revenue | 111,861,775.3 | 138,595,875.8 | -19.29% |

| Cost of sales | -73,217,018.2 | -97,131,483.7 | -24.62% |

| Gross Profit | 38,644,757.1 | 41,464,392.1 | -6.80% |

| Selling And Distribution Expenses | -4,679,155.2 | -4,647,208.8 | 0.69% |

| Administrative Expenses | -1,945,065.4 | -2,201,366.5 | -11.64% |

| Other income | 4,155,833.4 | 5,351,653.9 | -22.34% |

| Other operating expenses | -2,285,298.5 | -2,252,998.4 | 1.43% |

| Profit Before Interest And Tax | 33,891,071.3 | 37,714,472.2 | -10.14% |

| Finance cost | -8,368,630.8 | -9,258,483.1 | -9.61% |

| Others | 6,954,320.5 | 1,188,046.0 | 485.36% |

| Profit before taxation | 32,476,761.1 | 29,644,035.2 | 9.56% |

| Taxation | -11,314,531.2 | -10,338,922.1 | 9.44% |

| Profit After Tax | 21,162,229.9 | 19,305,113.1 | 9.62% |

Cements Sector Vs. KSE-100 Index 1-Year Performance

.jpeg)

Copyright Mettis Link News

Posted on:2024-03-08T12:04:50+05:00

43823