February 07, 2024 (MLN): The Cabinet Committee on Energy (CCOE) has approved the Oil Refinery Policy for upgradation of existing/brownfield refineries.

This paves the way for creating an enabling environment for the long-term sustainability of current refineries and attracting foreign investment in new refinery projects.

To note, three minor tweaks were made, which include the upgrade agreement to now be signed within 60 days, up from the previous one-month timeframe.

Additionally, the cap on incentives for refinery projects based on used equipment has been raised to 24.5% from 22%, compared to 27.5% for those utilizing new equipment.

Furthermore, the Implementation/Policy Committee will now comprise secretaries from the Petroleum, Finance, and Law divisions.

The government, through this policy, aims to provide necessary incentives/facilities to attract investment in this sector.

Under the brownfield policy, all existing refineries can upgrade their refineries to produce environmentally friendly fuels as per Euro-V specifications and to maximize the production of Motor Gasoline and Diesel by minimizing furnace oil (FO)/ other fuels.

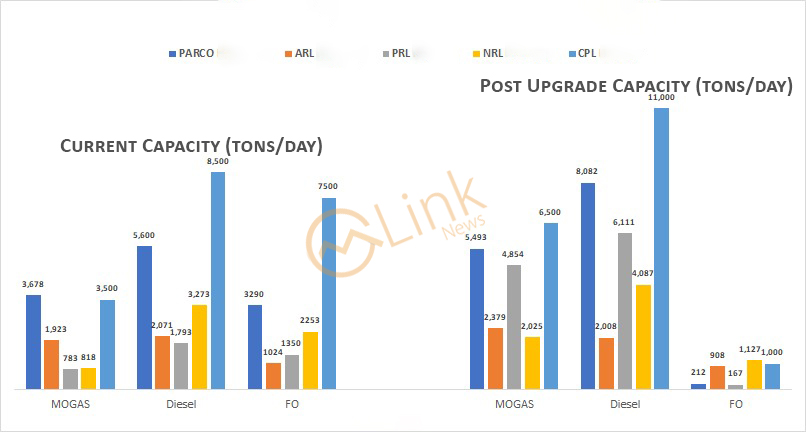

The current production capacity of PARCO for MOGAS is 3,678 tons per day, for Diesel is 5,600 tons per day, and for Fuel Oil (FO) is 3,290 tons per day where after the upgrade, the production capacity for MOGAS is projected to increase to 5,493 tons per day, for Diesel to 8,082 tons per day, and for Fuel Oil (FO) to 212 tons per day.

Similarly, the current production capacity of all the other refineries and after upgradation is mentioned below:

At present, Pakistan’s oil refining capacity is about 450,000 barrels per day (bpd), equivalent to 20 million tons per annum. However, the actual capacity utilization is at around 10m tons.

This is mainly due to the decreasing FO demand in the country as a result of a change in the energy mix in the power sector.

It is important to note that in essence the production slate for refineries is fixed. i.e., they cannot produce just MS or HSD, all products are produced simultaneously. Thus, as FO demand declines, refineries have to lower their overall production and struggle to maintain their throughput at optimal levels.

Historically, local refineries have supplied about 45% of the country’s requirements of HSD, 30% of MS and more than 100% of Jet fuel for defence. The rest of the demand is supplied through imported refined products.

As per the forecast by an international consultant, Pakistan’s demand for MS and HSD is expected to reach 33m tons per annum (mpta) by 2035.

Copyright Mettis Link News

Posted on:2024-02-07T10:18:36+05:00

43143