June 20, 2022 (MLN): In the backdrop of dismal macros along with the absence of the IMF tranche and delay in FATF’s decision, the Pakistani rupee (PKR) has lost a further 1.21 rupees as the currency settled today’s trade in the interbank market at PKR 209.96 per USD, compared to the previous close of 208.75 per USD.

During the day, the local unit was being traded in a range of 1.75 rupees, witnessing an intraday high of 210 per USD and an intraday low offer of 208.90. While in the open market, PKR was traded at 210.50/212.50 per USD.

Speaking to Mettis Global, Malik Bostan, President of Forex Association of Pakistan said, “Given the bleak situation of the interbank market where PKR is losing its value very fast, the Government should fix the matters at the earliest.”

Due to the foreign banks’ demand for 100% cash return, opening LCs has made the matter worst as it has increased the demand for dollars hence creating panic in the market, he added.

He highlighted that the demand for dollars by the energy sector revolves around $120 million each day which has to be fulfilled under the condition of 100% cash return.

To resolve this issue, he suggests that the government should discuss the matter with exporting countries since Pakistan still has enough resources to pay the import bill of energy products.

As per market experts, there is a dire need for government intervention otherwise, Pakistan will have to pay the hefty price in terms of a severe economic crisis.

Zafar Paracha, President of Exchange Companies Association of Pakistan noted, “Government’s silence and ignorance over PKR depreciation show that it may be a part of IMF agreement.”

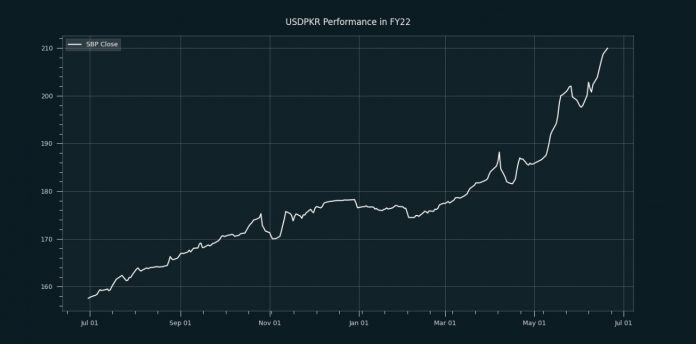

From July’21 to date, the local unit has lost Rs52.41 against the USD. Similarly, the rupee fell by Rs33.44 in CY21, with the month-to-date (MTD) position showing a decline of 5.48%, as per data compiled by Mettis Global.

During the last 52 weeks, PKR lost 24.98% against the greenback while reaching its lowest at 209.96 today, and the highest of 157.51 on June 21, 2021.

Furthermore, the local unit has weakened by 15.61% since its high on July 02, 2021, against EUR while, it has dropped by 15.55% against GBP since its high on July 02, 2021.

The performance of the local unit remained bleak against other major currencies during MTDY as the currency lost its value by 5.48%, 5.44%, 5.05%, 5.02%, 3.81%, 2.73%, and 0.43% against AED, SAR, CNY, CHF, EUR, GBP, and JPY, respectively.

Meanwhile, the currency lost 51 paisa to the Pound Sterling as the day's closing quote stood at PKR 257.27 per GBP, while the previous session closed at PKR 256.76 per GBP.

Similarly, PKR's value weakened by 1.8 rupees against EUR which closed at PKR 221.34 at the interbank today.

On another note, within the money market, the overnight repo rate towards the close of the session was 12.75/12.80 percent, whereas the 1-week rate was 13.50/13.60 percent.

Copyright Mettis Link News

33569