October 24, 2023 (MLN): International Steels Limited (PSX: ISL) unveiled its profit and loss statement for 1QFY24, wherein the profit after tax clocked in at Rs1.12 billion [EPS: Rs2.57] compared to a profit of Rs448.46 million [EPS: Rs1.03] in the same period last year (SPLY).

Going by the results, the company's top line inflated by 16.10% YoY to Rs19.21bn as compared to Rs16.54bn in SPLY.

The cost of sales rose also by 17.04% YoY but was less than proportionate to sales decline, which improved the gross profit by 10.05% YoY to Rs2.46bn in 1QFY24.

During the review period, other income surged by around 4x YoY to stand at Rs124.89m in 1QFY24 as compared to Rs25.46m in SPLY.

On the expense side, the company observed a rise in sales and distribution expenses by 5.62x YoY while reducing other operating charges by 81.27% YoY to clock in at Rs368.37m and Rs145.14m respectively during the review period.

The company’s finance costs also dipped by 77.31% YoY and stood at Rs195.68m as compared to Rs862.56m in 1QFY23.

On the tax front, the company paid a higher tax worth Rs656.09m against the Rs46.01m paid in the corresponding period of last year, depicting a rise of 1326.10% YoY.

| Unconsolidated (un-audited) Financial Results for Quarter ended 30 September, 2023 (Rupees in '000) | |||

|---|---|---|---|

| Sep 23 | Sep 22 | % Change | |

| Sales | 19,207,230 | 16,544,117 | 16.10% |

| Cost of sales | (16,742,374) | (14,304,426) | 17.04% |

| Gross Profit | 2,464,856 | 2,239,691 | 10.05% |

| Sales and distribution expenses | (368,367) | (65,471) | 462.64% |

| Administrative expenses | (107,386) | (67,574) | 58.92% |

| Other Income | 124,885 | 25,463 | 390.46% |

| Other operating charges | (145,141) | (775,086) | -81.27% |

| Finance cost | (195,684) | (862,558) | -77.31% |

| Profit before taxation | 1,773,163 | 494,465 | 258.60% |

| Taxation | (656,093) | (46,006) | 1326.10% |

| Net profit for the period | 1,117,070 | 448,459 | 149.09% |

| Basic earnings/ (loss) per share | 2.57 | 1.03 | – |

Amount in thousand except for EPS

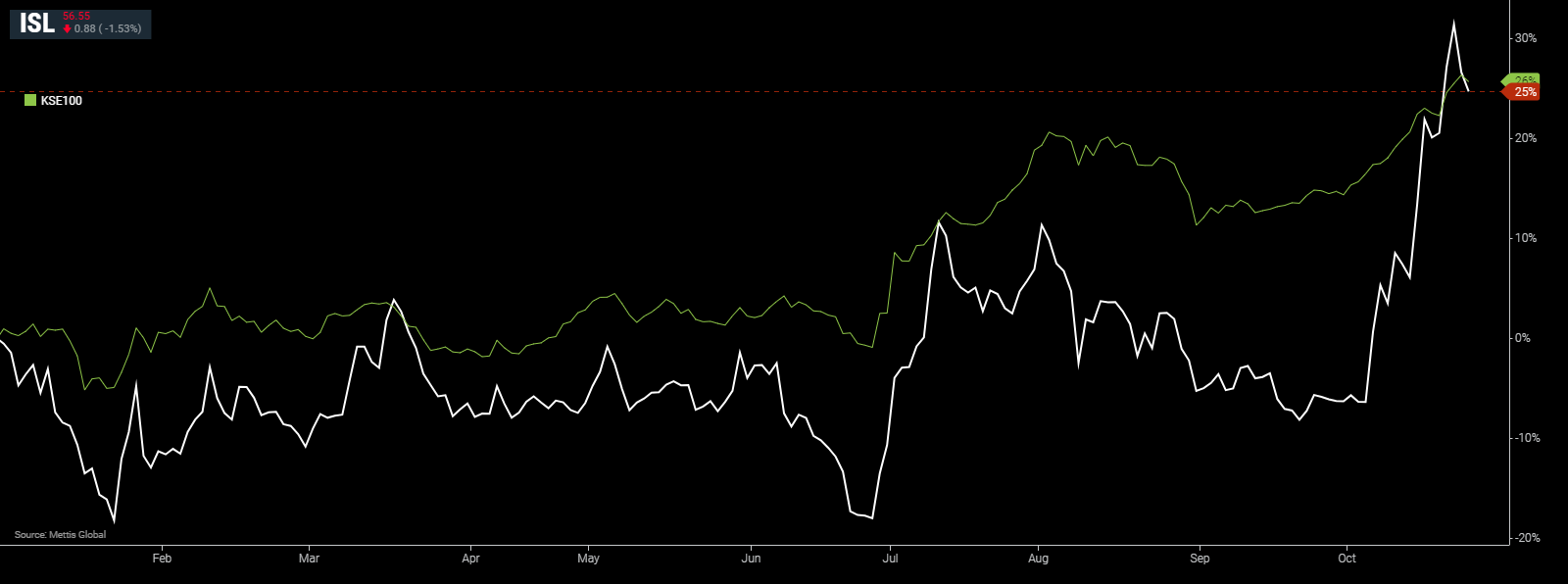

ISL and KSE-100 YTD Performance

Copyright Mettis Link News

Posted on:2023-10-24T13:36:08+05:00

41104